Is Lendly Loan Legit? What You Need To Know In 2024

In our world today, where things are always moving, people often look for financial help that makes sense for them. You know, like how some parts of the economy, say the pet industry, are really growing. For instance, the global market for pet food hit $109 billion in 2022, and the whole pet industry showed an economic contribution of $303 billion in 2023. Even with all that growth happening in some areas, personal money needs still pop up for many people. When you need a little cash, perhaps for something unexpected, a name like Lendly might come up. So, is Lendly loan legit, you might wonder?

When you are thinking about any kind of online financial service, it is very smart to ask questions. You want to be sure you are dealing with a real company. It is important to check out reviews and company details. This helps you figure out if a website is trustworthy or if it might be a problem. You just want to feel good about where your money comes from or goes.

This article aims to help you get a clearer picture of Lendly as a loan provider. We will look at what they offer, how their service works, and what people say about it. By the end, you should have a better idea if Lendly could be a suitable option for your financial needs. We will also clear up any confusion about other services that share a similar name.

- Who Did Adam Sandlers Daughter Play In Happy Gilmore 2

- Was Adam Sandlers Daughter In The Movie Happy Gilmore 2

- Labarina Season 1 Episode 1

- Ai Undress Photo Editor Free Porn

- Did Heidi Klum Have A Baby

Table of Contents

- Understanding Lendly: The Loan Provider

- How Lendly Loans Work

- Lendly and Your Credit History

- Clearing Up the Lendly Name Confusion

- Frequently Asked Questions About Lendly Loans

Understanding Lendly: The Loan Provider

Lendly is an online company that gives out small loans. They help people who need a bit of money quickly. This service is for folks who have had a job for at least six months. It is good to know that you do not need perfect credit to get a loan from Lendly. This makes it a choice for many different people, you know, who might not fit the usual bank requirements.

The loans they offer are installment loans. This means you get a set amount of money and pay it back over time. Lendly makes it easy to stay in control of your money. They give you a line of credit that ranges from $300 to $1,500. This kind of setup gives you the freedom to get cash when you really need it. It is rather flexible, which is a big plus for many.

They also mention that funding can be quick. You could get your money in as little as 24 hours. This speed is a major benefit if you are facing an urgent cost. There are no hidden fees or extra trouble, which is something many people really appreciate when getting a loan. It means you can plan your finances without surprises, which is good, actually.

- What Do People Post On Onlyfans

- Is Somalia Safe

- Congressman Salary

- Does Telegram Work In Uae

- Celine Dions Death Cause

How Lendly Loans Work

Applying for a loan with Lendly is done online. It is a straightforward process, which is a relief for anyone short on time. They aim to make things simple and clear. You can ask for amounts like $1,000, $1,500, or even $2,000. These are the small loans they mention, which are often good for unexpected bills or short-term needs, you see.

One of the main things Lendly looks at is your job history. You need to have been working for at least six months. This shows them that you have a steady way to pay back the loan. It is a bit different from traditional lenders who might focus more on your credit score. This approach helps people who might have had credit troubles in the past, but who are now working and making money, too it's almost.

Once you apply, they work to get you the cash fast. The idea is to provide money when you need it most, without a lot of waiting. This quick turnaround is part of their appeal. They want to make the process smooth and hassle-free, which is what anyone wants from a financial service, right?

Lendly and Your Credit History

When you apply for a Lendly loan, something called a credit inquiry will probably show up on your credit history. This is a normal part of applying for any loan. It is how lenders check your financial background. This inquiry might cause a small change to your overall credit score. It is important to be aware of this, obviously, as it is just how these things work.

The impact on your score is usually not very big. It is often described as a "small impact." However, it is still something to keep in mind if you are trying to improve your credit score. Every time you apply for new credit, it can leave a mark. Knowing this helps you make smart choices about when and how often you apply for loans, so.

Even though a stellar credit score is not a must-have for a Lendly loan, they still need to check your history. This is part of how they decide if they can lend to you. They need to see that you are a responsible borrower. It is a balance between being accessible and being careful, you know, for both sides.

Clearing Up the Lendly Name Confusion

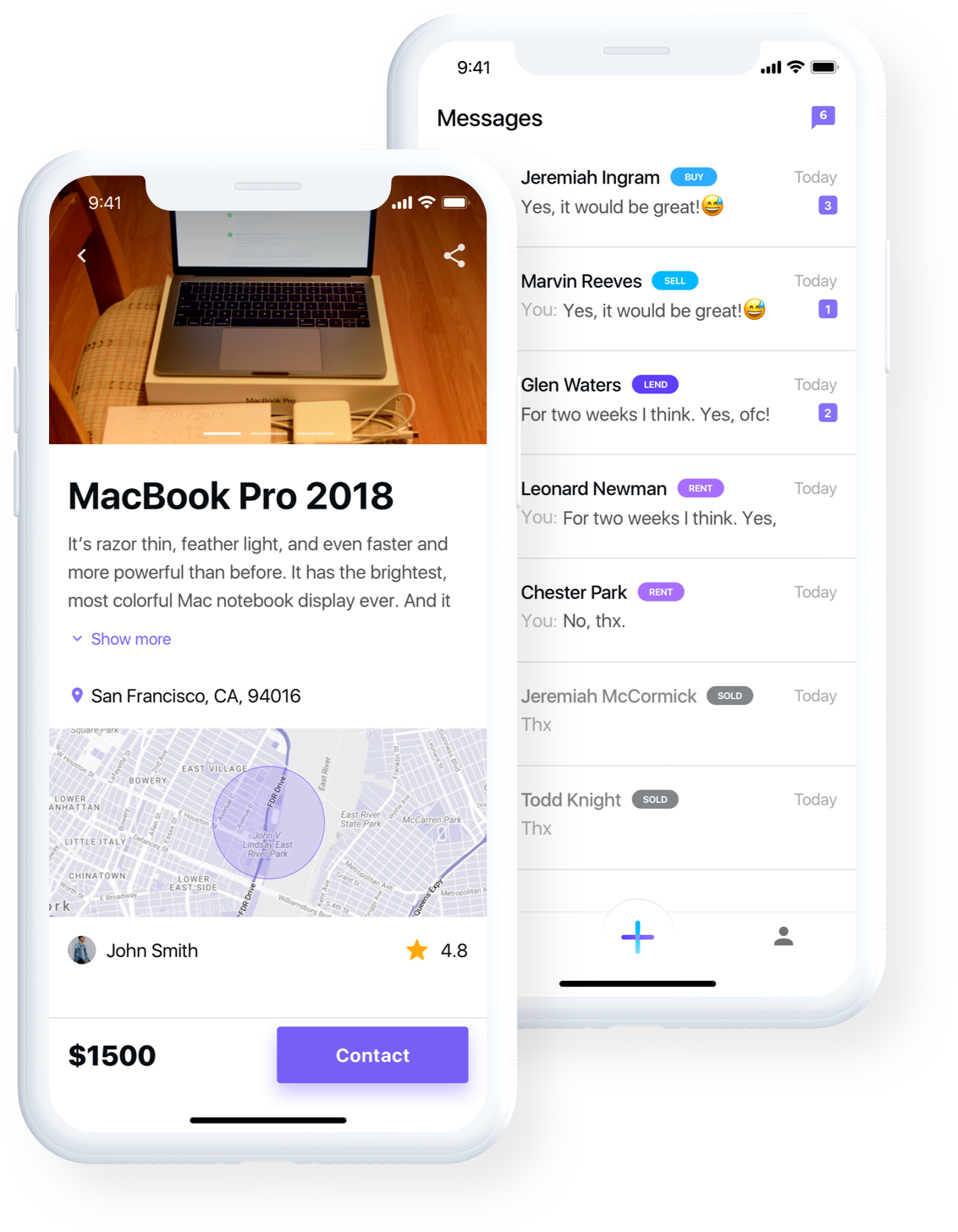

It is worth mentioning that there might be some confusion because the name "Lendli" appears to be used by different services. For example, some information talks about a "Lendli" where every item has a story and transactions are seamless. This particular "Lendli" reportedly started in a college dorm, with a founder named Mikhaile, focused on sharing things like textbooks. This sounds like a platform for renting or sharing items, not for giving out money, you see.

Then there is also "Lendli.org," which clearly states it is not a financial service. This "Lendli.org" does not get involved in loan requests, lending money, or processing financial deals. Any mention of "lending" on their site strictly relates to things other than money. They say their platform helps people find and rent items easily, making the experience safe and simple for anyone. This is quite different from what a loan company does, right?

For the purpose of figuring out if "lendli loan legit" is true, we are focusing on the online lender that offers small cash loans. This is the company that provides $300 to $2,000, requires six months of job history, and impacts your credit with an inquiry. It is good to keep these different uses of the name separate in your mind to avoid mix-ups, basically. This helps you make sure you are looking at the right service for your needs, you know, when you search online.

Frequently Asked Questions About Lendly Loans

Is Lendly a scam?

Based on the information available, Lendly operates as a legitimate online lender. They offer small loans to people who meet certain job history requirements. They also clearly state how applying might affect your credit. There is information about them providing fast cash and having no hidden fees. However, it is always a good idea to read reviews and understand all terms before you commit to any financial service, too it's almost. You can find more details about general online lending practices at a reputable financial resource like a financial resource website.

How does applying for a Lendly loan affect my credit?

When you apply for a Lendly loan, a credit inquiry will most likely show up on your credit history. This is a common practice for lenders. This inquiry may have a small effect on your overall credit score. It is not usually a big drop, but it is something to be aware of. This is just part of the process when you look for a loan, you know, so it's quite normal.

What kind of loans does Lendly offer?

Lendly offers online installment loans. These loans range from $300 up to $2,000. You can get amounts like $1,000, $1,500, or $2,000. They are designed to provide quick cash, sometimes as fast as 24 hours. These loans are for people with at least six months of job history, and you do not need perfect credit to be considered. Learn more about online installment loans on our site, and link to this page to understand how these loans function.

- Yungblud Billboard Picture

- What Do People Do On Onlyfans

- Is The Daughter In Happy Gilmore 2 Adam Sandlers Daughter

- Happy Gilmore Daughter Actress

- Telegram Bot Undress

Lendli

Legit Online Loan Apps Philippines | Manila

Mr. C Legit Online Loan - Home